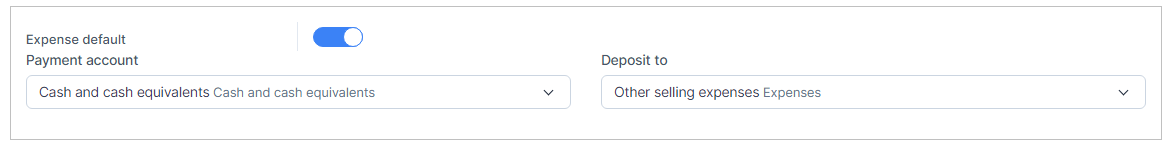

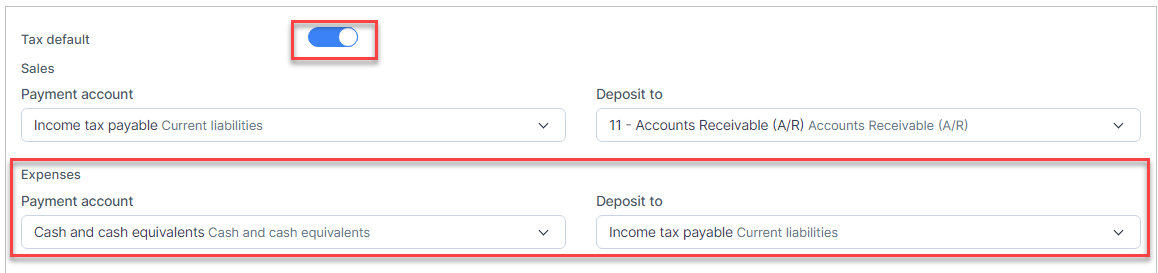

Step 1. Enable the Expense default and Tax default so expenses tax is mapped to the accounts

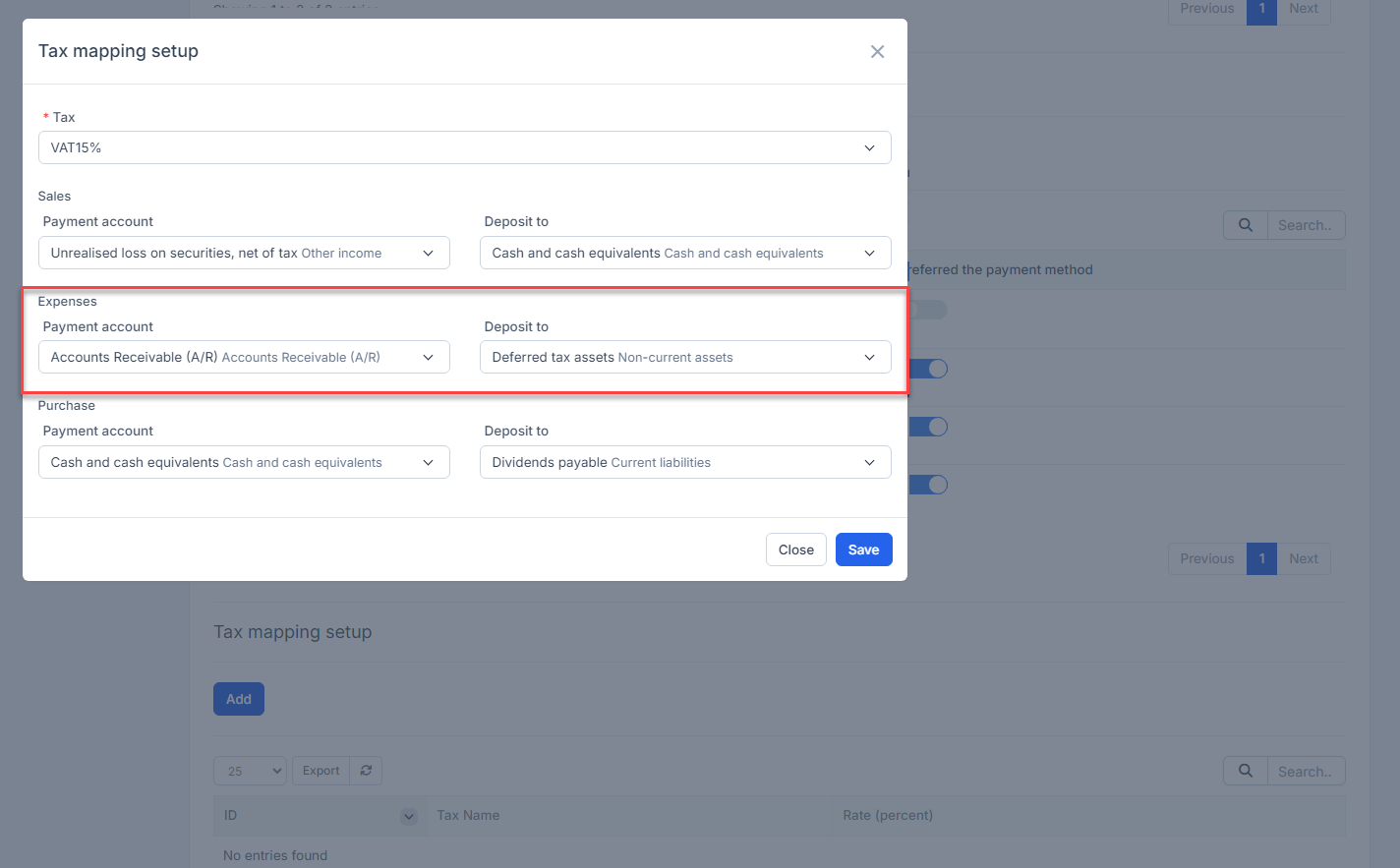

Step 2. Create the Tax mapping setup for VAT15%

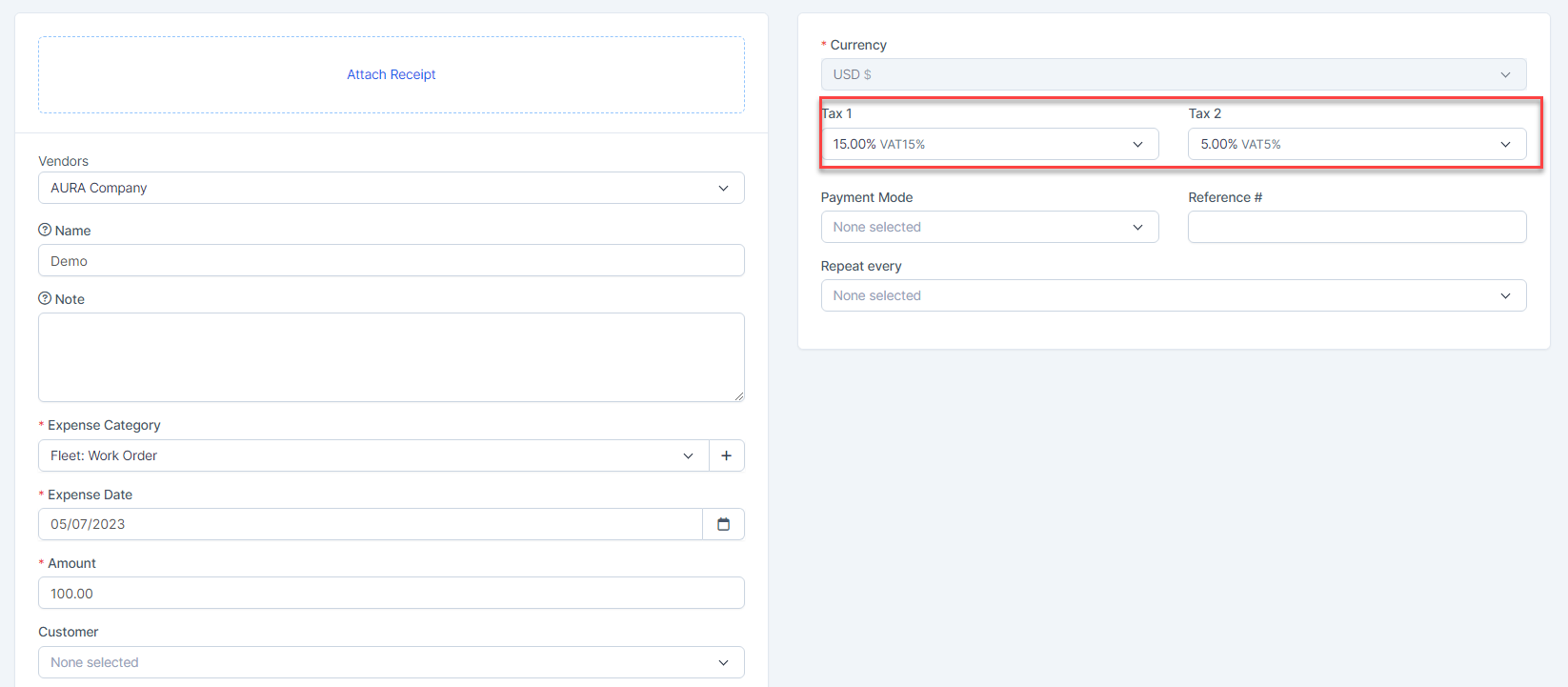

Step 3. Create the expense and select one or more taxes

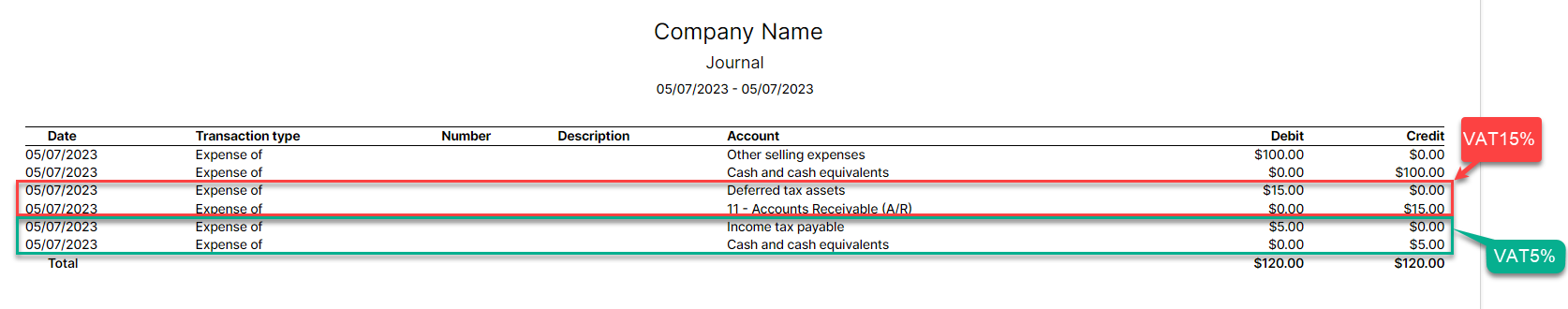

Result:

VAT15% mapped according to Tax mapping setup

VAT5% mapped according to Tax default

- NOTE:

- If Tax default is turned off, the tax cannot be mapped to the account but the expense amount is still mapped normally.

- If Expense default is turned off, expense is not automatically mapped.

- For SST, make sure a proper name and correct TAX rate is used.